[2025 Guide] How to Open a Japanese Bank Account Without Waiting 6 Months: The Ultimate Foreigner's Guide

CEO / Native Japanese Expert

Updated on: November 25, 2025

Think you can't open a bank account because you've been in Japan for less than 6 months? Think again. We reveal the "only bank" that accepts newcomers, the 4 essential items you need, and a hack to get a phone number without a bank account.

Introduction: Why is Opening a Bank Account in Japan So Hard?

"Moving to Japan, the first challenge wasn't the language. It was opening a bank account."

This is a sentiment shared by many foreigners we interviewed. You may have already experienced being told "No" at a bank counter. Or perhaps you are overwhelmed by a mountain of complex paperwork.

Rest assured, it's not because of your Japanese ability. The Japanese banking system operates under strict "Foreign Exchange Act" regulations to prevent money laundering.

However, with the right knowledge and strategy, you can break through this wall.

Based on the latest information as of November 2025 and real reviews from senior expats, this article presents the "only correct answer" on which bank to choose for the fastest approval.

What You Will Learn

- ✅ The Verdict: The "only bank" where you can open an account even if you've been in Japan for less than 6 months.

- ✅ Real Talk: App vs. Counter – which is better? (Based on user reviews)

- ✅ The Hack: How to get a phone number without a bank account (the chicken-and-egg problem).

- ✅ Money Saving: How to avoid "Non-Resident Fees" when transferring money.

⚠️ Important Update (Nov 2025) As of December 1, 2025, the current Health Insurance Card will no longer be accepted as a valid ID. If you do not have a My Number Card, we strongly recommend completing your bank account opening NOW (within November). Screening may become stricter after December.

The Biggest Hurdle: The "6-Month Rule" Explained

90% of rejections at bank counters are due to this rule.

1. Why "6 Months"?

Under Japanese law (Foreign Exchange and Foreign Trade Act), foreigners who have been in Japan for less than 6 months are defined as "Non-Residents." Since standard savings accounts at Japanese banks are designed for "Residents," legally, they cannot offer regular accounts to Non-Residents (or can only offer accounts with limited functions).

2. Are There Exceptions?

Yes. There are two main routes.

Route A: Japan Post Bank (Yucho Ginko)

- Condition: You must have at least 3 months remaining on your visa.

- Feature: The most flexible bank for foreigners in Japan. Even immediately after arrival, if you have a visa of 3 months or more, the probability of opening a "General Savings Account" is extremely high.

Route B: Proof of Employment (SBI Shinsei Bank, etc.)

- Condition: You can prove you are working for a company in Japan (Employee ID, Employment Contract).

- Feature: Even if it's less than 6 months, there is a special exception where you are treated as a "Resident" if you are actually working in Japan.

Quick Verdict: Which Bank is for You?

| Your Situation | Recommended Bank | Success Rate |

|---|---|---|

| Student / Unemployed (< 6 months) | Japan Post Bank (Yucho) | ⭐⭐⭐⭐⭐ |

| Employee (< 6 months) | SBI Shinsei Bank or Yucho | ⭐⭐⭐⭐ |

| Anyone (> 6 months) | Rakuten Bank, SBI Shinsei, etc. | ⭐⭐⭐⭐⭐ |

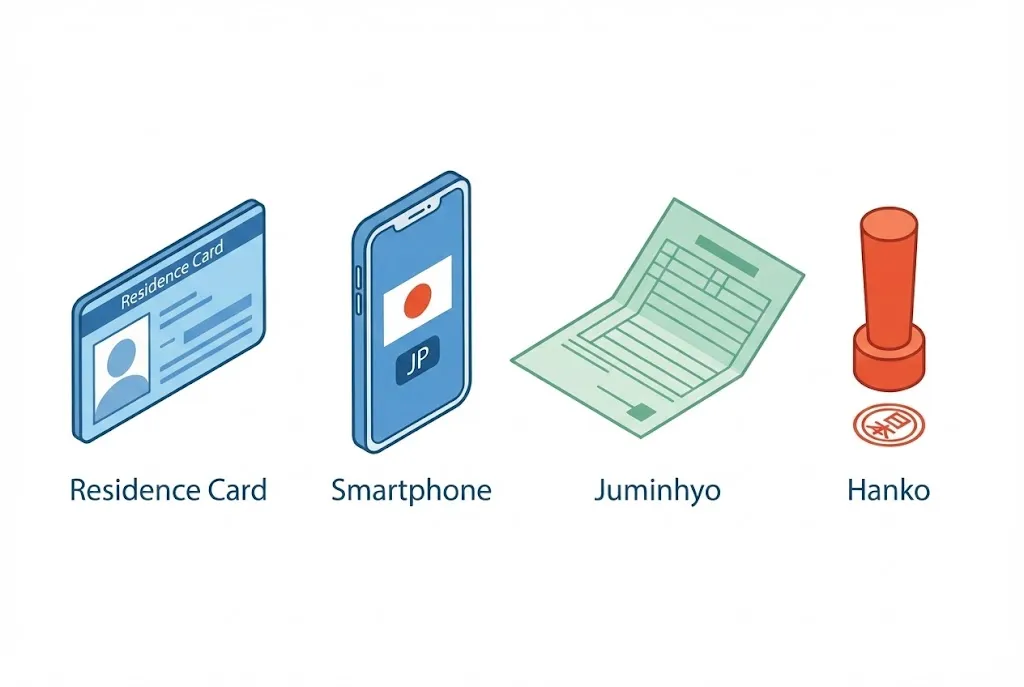

The "4 Sacred Treasures": Required Documents Checklist

Before going to the bank, ensure you have these four items. Missing even one will result in being sent home immediately.

1. Residence Card (Zairyu Card) [Mandatory]

This is the core of your ID.

- Crucial Check: Is your "Current Address" printed on the back? If your address is undecided immediately after entry, you cannot open an account. The absolute first step is to register your address at the City Hall and get it printed on the back of the card.

2. Japanese Phone Number [The Biggest Bottleneck]

Many foreigners stumble here. Banks require a "Japanese mobile number (090/080/070) where you can be contacted."

- 050 Numbers (IP Phone)? Mostly NG. They don't support SMS verification, failing security requirements.

- Friend's Number? NG. It must be in your own name.

Solution: Get a SIM card that you can contract without a bank account first. These are the "keys" to opening a bank account.

💡 Recommended SIMs Without a Bank Account Only the following two companies can solve the "No bank, no phone / No phone, no bank" dilemma.

- Mobal SIM: No credit card required. Contract with just a passport.

- GTN Mobile: Specialized for foreigners. Convenience store payment OK.

3. Certificate of Residence (Juminhyo)

Some banks (especially when opening at a counter) require this. Follow the bank's instructions regarding whether to include your My Number (Individual Number).

- Tip: If you have a My Number Card, you can print this at a convenience store 24/7.

4. Hanko (Personal Seal)

"Do I still need a stamp?" — In 2025, the situation is changing.

- App / Online Banks: Basically not required (Signature or Face ID).

- Japan Post Bank (Counter): Often required.

- Advice: Avoid 100-yen shop stamps (they might be rejected for bank registration).

Top 3 Banks Comparison: Which One Fits You?

1. Japan Post Bank (Yucho Bank)

- Verdict: If in doubt, choose this. Yucho is the only choice for your first bank account in Japan.

- Why: Most flexible screening, ATMs everywhere. Using the "Yucho Tetsuzuki App," you can open an account via face authentication without visiting a branch.

2. SBI Shinsei Bank

- Verdict: Best if you want to bank in English.

- Why: Their online banking supports English, making it safe for those not confident in Japanese. With their "Step Up Program," you can get free transfers to other banks if conditions are met.

3. Rakuten Bank

- Verdict: Best as a second bank after settling down.

- Why: Completely online, earns Rakuten Points. However, "Non-Residents (less than 6 months)" are explicitly not allowed to open an account. Wait for half a year.

🗣️ Real User Voices (2024-2025)

Here are the "Success Stories" and "Failures" from foreign residents in Japan, gathered from Reddit and X (Twitter).

✅ Success Stories (Good News)

Reddit User (2025) "Successfully opened a Yucho account in my first week. The app has English, and it was much less stressful than being bombarded with Japanese at the counter."

X User (Company Employee) "I showed my employee ID, and even SBI Shinsei Bank waived the '6-month rule'! If you are an employee, bringing proof of salary deposit is the strongest shortcut."

❌ Failures & Warnings (Bad News)

Reddit User (The Biggest Trap) "Rejected 3 times on the Yucho App. The reason? 'Katakana Name Input.' My Residence Card only has English, but the app demands perfect Katakana input. If you're not confident, going to the counter is faster."

Reddit User (Student) "I opened an account within 6 months, but there was a trap. Because it's treated as a 'Non-Resident Account,' when I tried to transfer money domestically (to pay rent), they tried to charge me 7,500 yen as an 'International Transfer' fee. Until 6 months pass, it's just a 'Cash Box'."

Practical Guide: Steps to Open a Yucho Account (Recommended Route)

Here is how to open an account using the "Yucho Tetsuzuki App," which has the highest success rate.

- Step 0: Preparation

- Residence Card (with address on back)

- Smartphone

- Japanese Phone Number (Must receive SMS)

- Step 1: Download the App

- Get "Yucho Tetsuzuki App" from the store. Select your language (English, Vietnamese, Chinese, etc.).

- Step 2: Identity Verification (eKYC)

- Follow the instructions to scan your Residence Card chip and take a selfie.

- Step 3: Information Input (The Hardest Part)

- Name: Input in Alphabet exactly as on your Residence Card.

- Kana: Input the Katakana pronunciation of your name accurately (e.g., SMITH → スミス). If this differs even by one character from what the bank expects, you will fail the screening.

- Step 4: Receive Cash Card

- Once screening is complete (approx. 1-2 weeks), the card will be sent via registered mail. You must be at home to receive it.

Troubleshooting

Q. I keep getting a "Name (Kana)" error on the app.

A. This is the most common reason for rejection. Your Residence Card only has English, but the bank system requires "Katakana" registration. If your input (e.g., スミス) differs from the bank's expected Katakana (e.g., スミース), you will be rejected. Solution: If it fails repeatedly, give up on the app and go to the counter. Ask the staff to confirm the Katakana reading while processing.

Q. I received an email saying "Account Opening Refused." Why?

A. Common causes include:

- Less than 3 months remaining on your visa.

- Address input does not match the Residence Card exactly (e.g., missing room number).

- You already have a Yucho account (Rule: 1 account per person).

Next Step: What to Do After Opening (Avoid the Fee Trap)

Opening a bank account is not the "Goal," it's the "Start." However, many people fall into the "Fee Trap" here.

⚠️ Warning: Do NOT use the bank for "Transfers" in the first 6 months

Accounts opened within 6 months of arrival are legally treated as "Non-Resident Accounts." During this period, ATM withdrawals are free, but if you try to transfer money to another bank (e.g., for rent), it may be treated as an "International Transfer" even if it's domestic, costing thousands of yen (sometimes 7,500 yen!).

So, what should you do?

Solution: Use Wise

When sending money from your home country to Japan, or moving funds domestically, using a bank counter takes days and costs high fees. Wise allows for fast transfers with low fees, regardless of your "Non-Resident" status.

The smart foreigner's strategy is to use the newly opened bank account as a "place to receive salary" and leave transfers to Wise.

🚀 Don't Lose Money on Fees Register via the link below to get a fee-free transfer coupon for up to 75,000 yen. Register now to avoid the bank's "Non-Resident Fees."

👉 Register for Wise (Free Transfer Coupon Included) (Safe service used by 16 million people worldwide)

Summary: Start with "Yucho"

Opening a Japanese bank account is indeed a high hurdle for foreigners. However, if you follow this guide, you will succeed.

Your Action Plan:

- Today: Register your address at City Hall.

- Tomorrow: Get a phone number with Mobal SIM.

- Day After: Apply via "Yucho Tetsuzuki App" (Go to counter if it fails).

- After Opening: Register for Wise immediately to avoid high transfer fees.

With these 4 steps, your financial life in Japan will be free. Good luck!

Need help with life in Japan?

Visa, housing, work, money... Our experts are here to support you.

Check Support ServicesDisclaimer

※ The information in this article is accurate as of the time of writing. Laws and regulations may change, so please always check official sources for the latest information. We assume no liability for any damages resulting from the content of this article.