[Fee Comparison] Top 4 Money Transfer Services from Japan: Wise, SBI Remit, Revolut, Bank Transfer

CEO / Native Japanese Expert

Updated on: November 26, 2025

Are bank transfers ripping you off? We expose the "Hidden Costs." A thorough comparison of fees and speed for Wise, SBI Remit, and Revolut. Find the best way to send money in 2025!

When sending your hard-earned salary in Japan to your family back home or to your own overseas account, which service do you use?

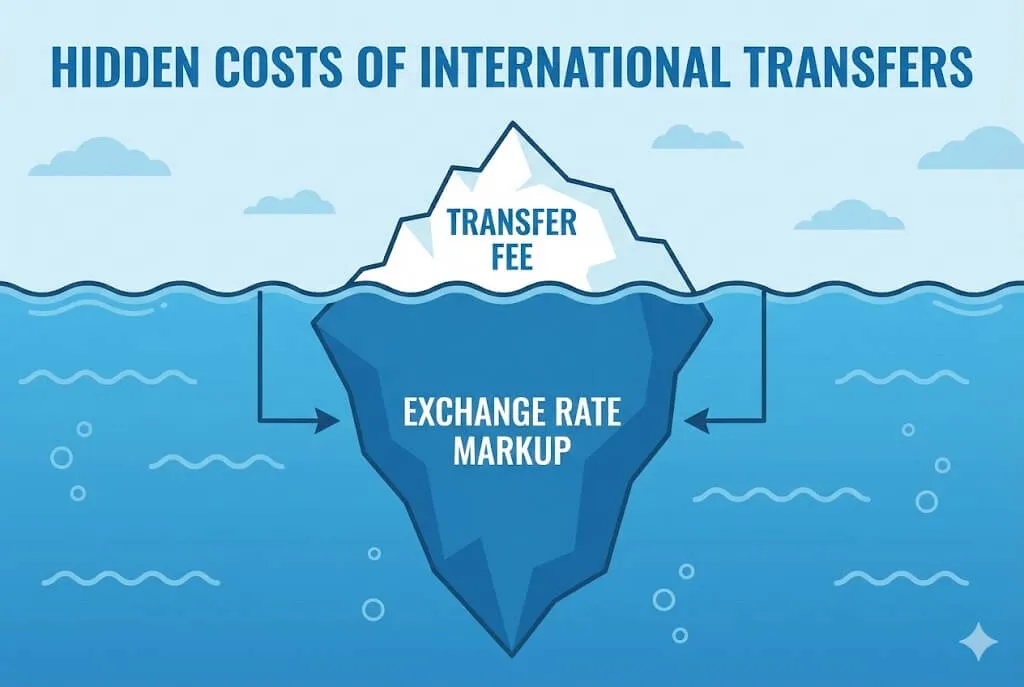

If you are using a "direct bank transfer," you might be losing thousands to tens of thousands of yen each time.

Behind the banks' advertisement of "0 Yen Transfer Fee," there is a trap called "Exchange Rate Markup (Hidden Cost)."

In this article, based on the latest data for 2025, we simulate "how much money actually arrives (Recipient Gets)" and propose the best money transfer service for you.

【Conclusion: The Best Transfer Method for You!】

| Smart Choice (No.1) | 🇵🇭🇻🇳 Cash Pickup | 💳 Daily Use |

|---|---|---|

| Wise | SBI Remit | Revolut |

| Zero hidden costs.<br>Much cheaper than banks | Family can pick up cash.<br>Strong in Asia | Free fees for small<br>weekday transfers |

| Visit Official Site | Visit Official Site | Visit Official Site |

1. The Truth About "Hidden Costs": Why are Bank Transfers Expensive?

Banks and some services advertise "0 Yen Transfer Fee!", but in reality, they add a markup to the exchange rate.

- Real Rate (Google Search): 1 USD = 150 JPY

- Bank Rate: 1 USD = 151 JPY (1 JPY Markup)

It may seem like a small difference of just 1 yen, but if you send 1 million yen, you lose about 6,600 yen. This is the "Hidden Cost."

On the other hand, Wise uses the "Real Rate (Mid-Market Rate)" and displays fees transparently, making the total cost overwhelmingly cheaper.

2. Real Fee Simulation: Sending 100,000 Yen

We calculated how much actually arrives if you send "100,000 JPY" from Japan to the US (USD). (Estimated rates for Nov 2025)

| Rank | Service | Recipient Gets (USD) | Verdict |

|---|---|---|---|

| 🥇 | Wise | $665.58 | Best. No hidden costs. |

| 🥈 | Revolut | $663.78 | Excellent on weekdays. Fees apply on weekends. |

| 🥉 | SBI Remit | $663.50 | Not bad, but slightly behind Wise. |

| 4th | Sony Bank | $661.05 | Decent for a bank, but loses on fees. |

| 5th | Mega Banks | ~$615.00 | Avoid. You lose about $50 (7,500 JPY). |

Conclusion: For transfers to bank accounts, Wise is the strongest.

3. Service Details: Features and Real Reviews

Here, we introduce not just the specs, but the "Real Voices (Reviews)" of foreign users actually using these services.

A. Wise (formerly TransferWise)

The standard for money transfer services used worldwide.

- Pros: Zero hidden costs. Fast arrival (Minutes to 1 day).

- Note: Residents in Japan must have a My Number Card (or Notification Card + ID).

📢 User Voices

👍 Good: "The exchange rate looked 15% worse compared to banks, but Wise uses the market rate, so it ended up being the cheapest. No hidden costs is the best." (Reddit)

👎 Bad: "If you keep more than 1 million yen in your account, you get a warning that it will be frozen (Japanese law). A bit inconvenient for large transfers." (Reddit r/JapanFinance)

👉 Get a Fee-Free Transfer Coupon for Wise

B. SBI Remit

Very popular among Technical Intern Trainees and Specified Skilled Workers. Partnered with MoneyGram.

- Pros: You can send money for Cash Pickup to family members in the Philippines or Vietnam who do not have bank accounts.

- Note: The exchange rate is slightly worse than Wise.

📢 User Voices

👍 Good: "It's a godsend that my family in the countryside can pick up cash in 10 minutes. Even if the rate is slightly worse, this convenience is irreplaceable." (Facebook Community)

👎 Bad: "There were too many documents required for registration, which was a hassle. The app usability feels a bit old." (Reddit)

👉 Visit SBI Remit Official Site

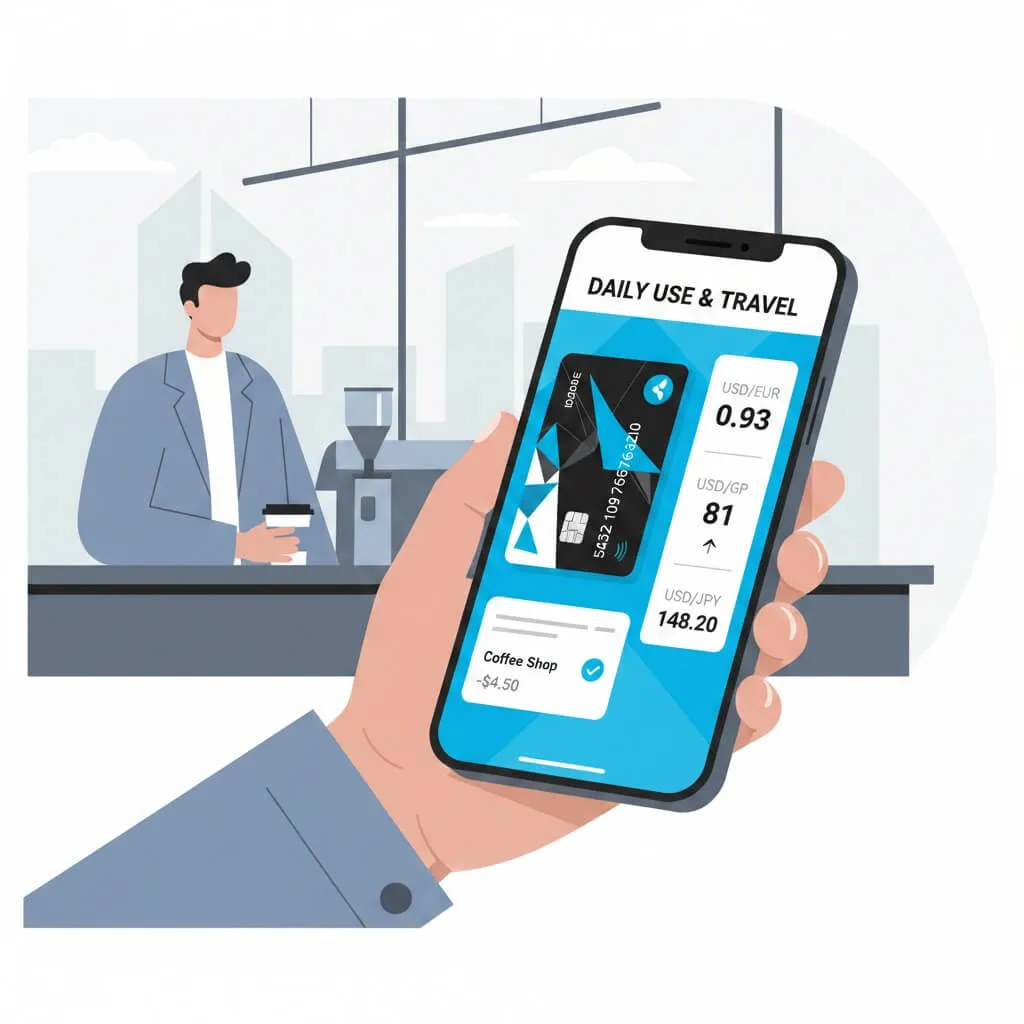

C. Revolut

A next-gen financial app also great for travel.

- Pros: No exchange fees for up to 750,000 JPY per month on weekdays. Excellent as a debit card.

- Note: There is a trap where a 1% fee is added if you send money on weekends (Sat/Sun).

📢 User Voices

👍 Good: "If you exchange money on weekdays, you don't pay fees even if you use the card on weekends. It's the best for travel." (Reddit r/JapanTravelTips)

👎 Bad: "I sent money in a hurry on Friday night and got hit with a 1% weekend fee. You must check the calendar if you use Revolut." (Twitter/X)

👉 Try Revolut Premium Free for 3 Months

D. Sony Bank

An online bank with perfect English support.

- Pros: The English online banking is easy to use. For large transfers over 1 million yen, it can be cheaper than Wise.

- Note: There is often a Lifting Charge (Intermediary Bank Fee) of around 2,500 JPY deducted on the receiving end.

📢 User Voices

👍 Good: "The only decent Japanese bank usable in English. I use Sony Bank when sending over 1 million yen for tuition." (Reddit r/JapanFinance)

👎 Bad: "I thought the fee was 3,000 yen, but another $25 was deducted on the receiving end. So this is the lifting charge..." (Reddit)

👉 Visit Sony Bank (MoneyKit) Official Site

4. Summary: Recommendations by Situation

-

"I want to send money as cheaply as possible" (Under 1 million JPY) 👉 Wise (First transfer fee-free with referral link)

-

"My family wants to receive cash" (Philippines, Vietnam, etc.) 👉 SBI Remit (Convenient MoneyGram partnership)

-

"I want to use it for travel" & "Can send on weekdays" 👉 Revolut (Worth trying the Premium free trial)

-

"Sending a large amount over 1 million JPY" 👉 Sony Bank or Wise (High amount discounts available)

Choose your service wisely and save on unnecessary fees!

Need help with life in Japan?

Visa, housing, work, money... Our experts are here to support you.

Check Support ServicesDisclaimer

※ The information in this article is accurate as of the time of writing. Laws and regulations may change, so please always check official sources for the latest information. We assume no liability for any damages resulting from the content of this article.