Nenmatsu Chosei vs. Kakutei Shinkoku: The Complete Tax Guide for Foreigners in Japan

CEO / Native Japanese Expert

Updated on: December 8, 2025

Nenmatsu Chosei vs. Kakutei Shinkoku: Which one do you need? A complete guide for foreign employees on forms, deadlines, and how to get your tax refund (often ¥100,000+).

"My company asked me to submit 'Nenmatsu Chosei' documents, but how is this different from filing a tax return?"

"Do I have to do both? Or is just one enough?"

Many foreign residents working in Japan are confused by the differences between these two systems. In fact, there was a post on Reddit where someone shared, "I missed my company's deadline and lost out on a ¥66,000 tax refund."

In this article, we will clearly explain the difference between Year-End Tax Adjustment (Nenmatsu Chosei) and Final Tax Return (Kakutei Shinkoku), and specifically guide you on which documents to submit and when.

⏰ Important Deadlines for 2025:

- Year-End Adjustment (Nenmatsu Chosei): By Nov 30, 2024 (varies by company)

- Final Tax Return (Kakutei Shinkoku): Feb 17, 2025 – Mar 17, 2025

If you follow the procedures correctly, you can receive an average tax refund of ¥20,000 – ¥100,000.

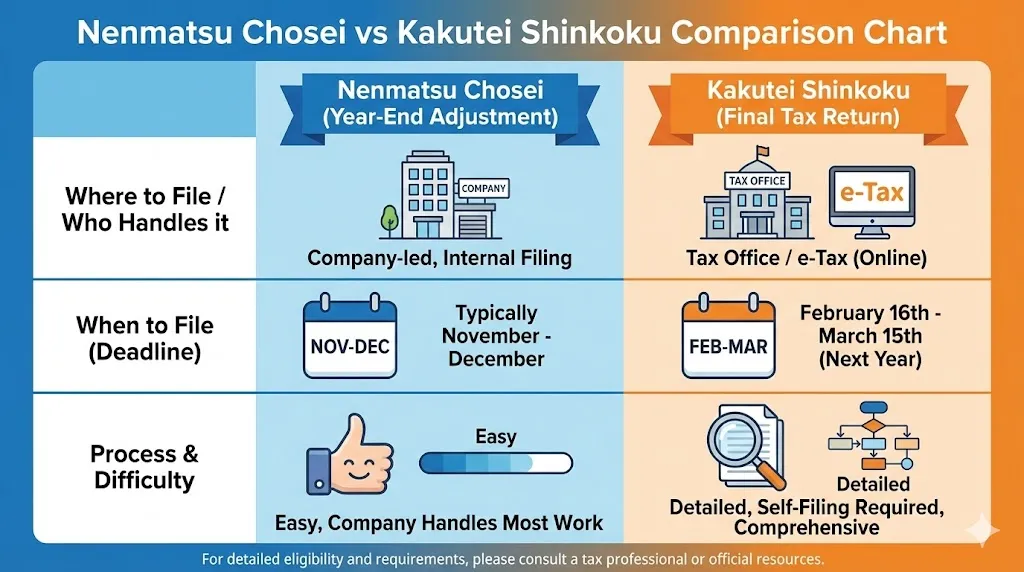

Nenmatsu Chosei vs. Kakutei Shinkoku: What's the Difference? [Comparison Table]

First, let's understand the basic difference between these two systems.

Nenmatsu Chosei (Year-End Adjustment) is a system where your company calculates and adjusts your taxes for you to correct any overpayment or underpayment. On the other hand, Kakutei Shinkoku (Final Tax Return) is where you personally report your annual income to the Tax Office.

Check the table below for the main differences.

| Item | Nenmatsu Chosei (Year-End Adjustment) | Kakutei Shinkoku (Final Tax Return) |

|---|---|---|

| Who is it for? | Company Employees (Salarymen/OLs) | People with side income, annual income over ¥20M, medical expense deductions, etc. |

| Deadline | Mid to Late November (Company deadline) | Feb 17 (Mon) – Mar 17 (Mon), 2025 |

| Who does it? | The Company does it for you | You do it yourself |

| Refund Timing | With Dec or Jan Salary | 2 weeks – 2 months after filing |

| Where to submit | Your Company | Tax Office (via e-Tax, mail, or in-person) |

Basic Rule: Employees usually only need Nenmatsu Chosei. Kakutei Shinkoku is only for "Special Cases."

For most company employees, tax procedures are completed just by doing the Year-End Adjustment. However, if you have a side job or high medical expenses, you will need to file a Final Tax Return.

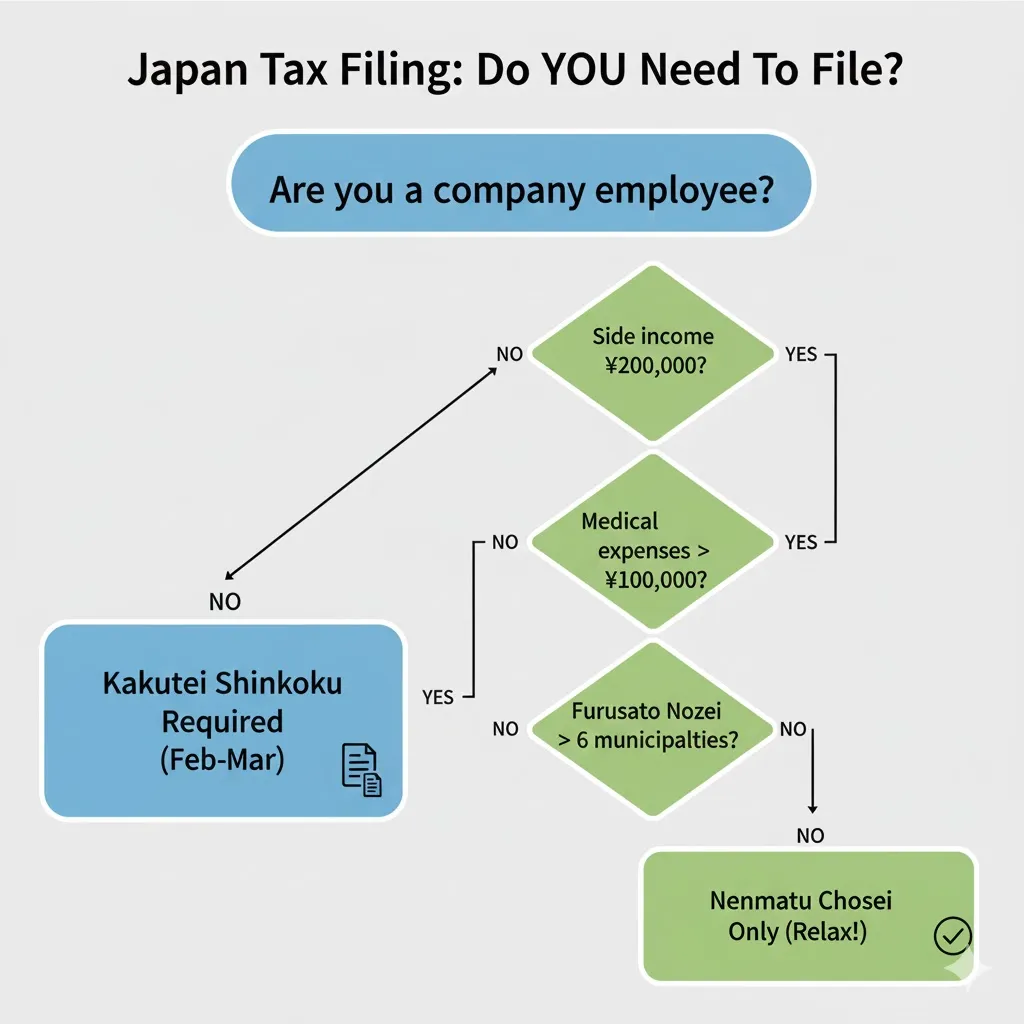

Which One Are You? Just Nenmatsu Chosei or Do You Need Kakutei Shinkoku?

Let's confirm which category you fall into.

You ONLY need Nenmatsu Chosei if:

- You receive a salary from only one company.

- Your side income is ¥200,000 or less per year.

- You do not plan to claim special deductions (like medical expenses or the first year of a mortgage deduction).

- You met your company's submission deadline.

If this applies to you, simply fill out the forms distributed by your company and submit them.

You MUST file a Final Tax Return (Kakutei Shinkoku) if:

If any of the following apply, filing a tax return is mandatory:

- Your annual salary is ¥20,000,000 or more.

- Your side income exceeds ¥200,000 per year.

- You work for two or more companies simultaneously.

- You quit your job mid-year and did not get re-employed by the end of the year.

- You returned from an overseas assignment or left Japan mid-year.

In these cases, the Year-End Adjustment alone cannot calculate your taxes correctly, so you must file a return yourself.

You SHOULD file a Final Tax Return to "Get Money Back" (Optional)

In the following cases, filing is not mandatory, but doing so may result in a tax refund:

- Medical expenses exceeded ¥100,000 per year (or 5% of income).

- You donated to 6 or more municipalities via Furusato Nozei.

- You are claiming a mortgage deduction for the first time (Year 1 only; Year 2+ is done via Nenmatsu Chosei).

- You forgot to do Nenmatsu Chosei or missed the company deadline.

- You forgot to submit life insurance deduction documents.

Notably, if you missed the Nenmatsu Chosei deadline, don't give up. You can still receive your refund by filing a Final Tax Return (Feb 17 – Mar 17, 2025).

Warning for Furusato Nozei Donors

If you donated to 6 or more municipalities, the 'One-Stop Exception' does not apply, and a Final Tax Return is mandatory. If you miss the deadline, you lose the tax deduction.

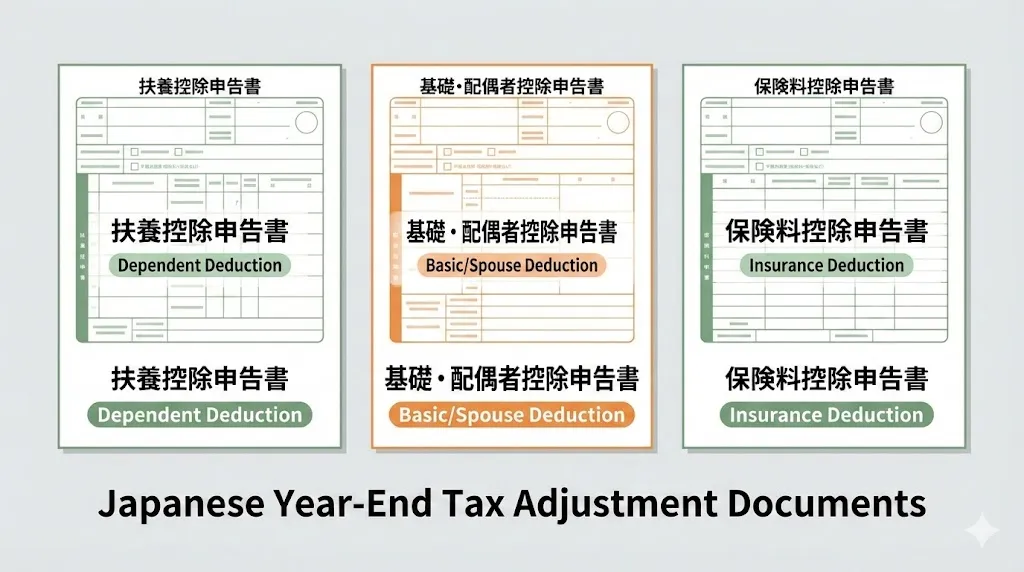

How to Fill Out Nenmatsu Chosei Forms [Complete Guide to the 3 Forms]

There are three main types of documents you submit for Year-End Adjustment. Let's look at how to fill them out.

Deadlines and Flow

The general schedule is as follows:

- Late Oct – Early Nov: Forms are distributed by the company.

- Nov 15 – Nov 30: Submission deadline (varies by company).

- Dec or Jan: Tax refund is paid out with your salary.

⚠️ Important: If you miss this deadline, you must file a Final Tax Return yourself (Feb 17 – Mar 17) to get your refund.

Check your company's specific deadline and prepare early.

Form ①: Dependent Deduction Declaration (Fuyo)

Official Name: 給与所得者の扶養控除等(異動)申告書 (Maru-Fu)

Purpose: Mandatory form to claim the basic deduction and dependent deduction. If you don't submit this, you will be taxed at the highest rate.

Key Items to Fill:

- Name, Address, DOB, My Number

- Must match your Residence Card exactly (including spaces and capitalization).

- Spouse Information (if married)

- Name, DOB, My Number.

- Fill this in only if your spouse's income is ¥1,030,000 or less.

- Dependent Relatives (Family you support)

- Children, parents, etc., whom you support financially.

- Deduction amount: ¥380,000 – ¥630,000 per person (depending on age and residency).

Crucial Note for Foreign Residents:

If you are claiming dependents living outside Japan (e.g., parents back home), the following documents are MANDATORY:

- Remittance Record: Bank statements or transfer slips proving you send money regularly.

- Proof of Relationship: Birth certificate, Marriage certificate (Original + Japanese translation).

- Income Proof: Proof that the relative earns below the threshold.

Rules were tightened in 2023. If documents are missing, the deduction will be rejected.

Form ②: Basic / Spouse / Income Adjustment Deduction Declaration

Official Name: 給与所得者の基礎控除申告書 兼 配偶者控除等申告書 兼 所得金額調整控除申告書

Purpose: To declare your own income and your spouse's situation to calculate the deduction amount.

Key Items:

- Your Estimated Income for This Year

- Calculate the total from your Jan–Dec payslips.

- Enter "Income" (Shotoku - after deductions), not "Revenue" (Shunyu - gross pay).

- Spouse Information (if claiming spouse deduction)

- If spouse's revenue is ¥1,030,000 or less: Max ¥380,000 deduction.

- If spouse's revenue is ¥1,500,000 or less: You can still get a partial deduction (Special Spouse Deduction).

Common Mistake: Confusing "Revenue" (Gross Salary) with "Income" (After employment income deduction).

Form ③: Insurance Premium Deduction Declaration

Official Name: 給与所得者の保険料控除申告書

Purpose: To declare life insurance, earthquake insurance, or social insurance (if you paid directly) to reduce taxes.

Must-Attach Document: Insurance companies mail a postcard called "Deduction Certificate" (Kojo Shomeisho) to your home in Oct-Nov. You must staple this postcard to the form.

Additional Document for Job Changers

If you changed jobs during the year, the 'Gensen Choshu Hyo' (Withholding Slip) from your previous company is mandatory.

This slip records the salary and taxes you paid at your old job. If you don't submit this to your new company, your previous income won't be calculated, and you might end up paying double tax.

On Reddit, a user reported: "I didn't submit my old job's withholding slip when I switched jobs, and I ended up overpaying ¥50,000 in taxes."

If the old company won't issue it:

- Consult with Hello Work.

- Submit a "Notification of Non-Issuance of Withholding Slip" to the Tax Office.

Guide for Those Who Need to File a Final Tax Return (Kakutei Shinkoku)

If Nenmatsu Chosei doesn't cover your situation, you need to file a Final Tax Return.

Deadlines and Methods

2025 Tax Return Schedule:

- Tax Period: Income earned Jan 1, 2024 – Dec 31, 2024.

- Filing Period: Feb 17 (Mon) – Mar 17 (Mon), 2025.

- Submission Methods:

- e-Tax (Online): Refund deposited in 2-3 weeks.

- Mail / In-Person: Refund deposited in 1-2 months.

Recommendation: Use e-Tax to get your money back faster.

Wise is Best for Sending Refunds Overseas

If you receive your tax refund after leaving Japan, you need a Japanese bank account. Wise allows you to hold the account for free and send money abroad at the real exchange rate.

Required Documents Checklist

Mandatory for Everyone:

- Tax Return Form (Form A or B).

- My Number Card (or Residence Card + My Number Notification Card).

- Bank Account Info (to receive the refund).

- Gensen Choshu Hyo (Withholding Slip from company).

Additional Documents by Case:

Medical Expense Deduction

- Receipts from hospitals/pharmacies.

- Medical Expense Statement (download from Tax Agency site).

- Threshold: Expenses exceeding ¥100,000/year (or 5% of income).

Overseas Dependent Deduction

- Proof of Relationship.

- Remittance Record (Must be separate for each dependent).

Furusato Nozei (6+ cities)

- Donation Receipts (sent by municipalities).

e-Tax vs. Paper: Which is Better?

| Item | e-Tax (Online) | Paper (Mail/In-Person) |

|---|---|---|

| Refund Speed | 2-3 weeks | 1-2 months |

| Filing Hours | 24 hours / day | Business hours only |

| Requirements | My Number Card + Phone/PC | Print the forms |

| Blue Return Deduction | ¥650,000 | ¥550,000 |

| Pros | Fast, convenient, higher deduction | No tech setup needed, peace of mind |

Recommendation: If you have a My Number Card, e-Tax is overwhelmingly better.

:::ReviewBox{title="Real e-Tax User Feedback" description=""With my My Number Card, I finished filing on my phone in 15 minutes. I was surprised to see ¥80,000 deposited just 2 weeks later." (Reddit User, Office Worker, 30s)" rating="5" pros="・Fast refund (2-3 weeks)|・File anytime 24/7|・No need to visit Tax Office|・¥100k higher deduction for Blue Return" cons="・Initial setup required|・Need NFC-enabled phone|・Self-responsibility for typos"} :::

5 Common Pitfalls for Foreigners

Here are specific points foreign residents in Japan need to watch out for.

① Name Mismatch (Romaji vs. Katakana)

Problem: The name on tax forms doesn't match the Residence Card or Bank Account.

Solution:

- Write your name exactly as it appears on your Residence Card (All caps, Order: Surname - Middle - Given).

- Watch out for spaces.

- Example: If the card says "JOHN SMITH", the form must say "JOHN SMITH" (or the Katakana equivalent if required, exactly as registered).

② Missing Remittance Proof (Hand-carry cash)

Problem: Many foreigners bring cash home to parents or use informal services. This is NOT accepted for tax deductions.

Requirement:

- Must use a bank or licensed money transfer service (Wise, SBI, etc.).

- Must have a statement showing the sender (you) and receiver (dependent) clearly.

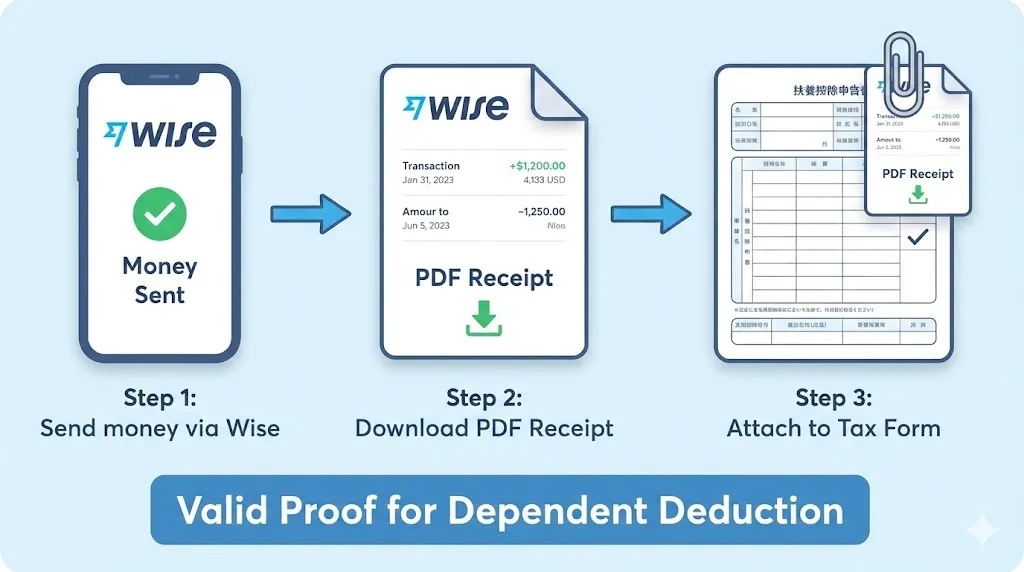

Use Wise for Easy Remittance Statements

Wise automatically saves transfer history and lets you download PDF statements. This is valid proof for dependent deductions. Real exchange rates, low fees.

③ Forgetting the Old Job's Withholding Slip

Problem: Changing jobs but failing to submit the old Gensen Choshu Hyo to the new company results in incorrect tax calculations.

Solution:

- Ask your old company for the slip immediately upon resigning.

- Submit it to your new company ASAP or during year-end adjustment.

④ Confusing "Nenmatsu Chosei" and "Kakutei Shinkoku" Deadlines

Problem: Thinking "The deadline is March" and ignoring the company's November deadline.

Correct Understanding:

- November: Deadline for the Company (for them to do it for you).

- Feb-Mar: Deadline for doing it yourself at the Tax Office.

If you miss the November deadline, you create more work for yourself in March.

⑤ Leaving Japan Without Filing Taxes

Problem: Quitting and leaving Japan mid-year without filing taxes means losing out on a refund you were entitled to.

Solution:

- Before leaving: Go to the Tax Office to file a "Quasi-final tax return" (Jun-kakutei Shinkoku).

- If already left: Appoint a "Tax Representative" (Nozei Kanriin - usually a friend in Japan) to file for you.

- Keep your Japanese bank account open to receive the refund.

3 Hacks to Maximize Your Refund

-

National Pension Catch-up Payments are Deductible

- If you pay back past due National Pension premiums (from the last 2 years), the full amount is deductible from your taxable income.

- Example: Paying ¥200,000 in back payments could get you ¥40,000 back in taxes.

-

Self-Medication Tax System

- Even if medical expenses are under ¥100k, if you buy over ¥12,000 worth of specific OTC medicines (check for the Self-Medication logo on the box), you can claim a deduction.

-

Furusato Nozei for Effectively ¥0

- If you donate during Rakuten sales campaigns, the points you earn can often cover the ¥2,000 administrative fee you have to pay.

Frequently Asked Questions (FAQ)

Q1: I forgot to do Nenmatsu Chosei. Is my money lost?

A: No. You can still get your refund by filing a Final Tax Return (Kakutei Shinkoku) yourself between Feb 17 and Mar 17, 2025.

Q2: How much is the refund usually?

A: Average is ¥20,000 – ¥100,000. It depends on dependents, insurance, etc.

- Single, with insurance: Approx ¥20,000 – ¥30,000.

- Married, supporting spouse: Approx ¥50,000 – ¥70,000.

- Supporting 2 kids + Insurance: Approx ¥80,000 – ¥100,000.

Q3: I earn ¥190,000/year from a side gig. Do I need to file?

A: You do not need to file a National Income Tax return if side income is under ¥200,000. However, you may still need to report it to your local city hall for Residence Tax (Juminzei) purposes.

Q4: I don't have a My Number Card. What do I do?

A: You can use your Residence Card + My Number Notification Card (paper) or a Juminhyo (Residence Certificate) with My Number listed. However, having the plastic My Number Card makes e-Tax much easier.

Q5: What do I need to claim parents back home as dependents?

A: Two main things:

- Birth Certificate (Proof of relationship) - With translation.

- Bank Remittance Record (Proof of support) - Must be sent to each person individually (e.g., one slip for Dad, one slip for Mom; do not send a lump sum to one person for both).

Q6: e-Tax is giving errors. Can I submit on paper?

A: Yes. You can print the forms and mail them or take them to the Tax Office. The refund takes a bit longer, but it is processed normally.

Summary: Stick to the Deadlines and Get Your Money Back

Here is a recap of the key points:

Golden Rules:

- Company employees should prioritize "Nenmatsu Chosei" (Deadline: Nov).

- If you have side income, high medical costs, or Furusato Nozei > 6 cities: You MUST do "Kakutei Shinkoku" (Feb-Mar).

- If you miss the company deadline, file Kakutei Shinkoku to "save" your refund.

Notes for Foreigners:

- Name must match Residence Card.

- Overseas dependents require valid remittance records (no cash hand-carry).

- Remember your old Gensen slip if you changed jobs.

Action Plan:

- Check if you need just Nenmatsu Chosei or Kakutei Shinkoku.

- Check your company's deadline (usually Nov) and prepare docs.

- Find your insurance deduction postcards.

- If it's too late, mark your calendar for February to file a tax return.

If you follow the procedures, you can get back ¥20,000 – ¥100,000 on average. Don't leave your money on the table!

Sending ¥50,000 Refund Home? Wise Saves You ¥3,500

Bank fees are around ¥7,000. Wise costs only about ¥3,500 with the real exchange rate. It's the top choice for expats. Free account, and auto-saved history works as tax proof.

Need help with life in Japan?

Visa, housing, work, money... Our experts are here to support you.

Check Support ServicesDisclaimer

※ The information in this article is accurate as of the time of writing. Laws and regulations may change, so please always check official sources for the latest information. We assume no liability for any damages resulting from the content of this article.