Residence Tax in Japan: Why Your Paycheck Shrinks in Year 2 & The "Leaving Japan" Trap

CEO / Native Japanese Expert

Updated on: December 6, 2025

Residence Tax in Japan is paid in "arrears." Why does your take-home pay decrease from June of your second year? What is the "January 1st Rule" that can cost you hundreds of thousands of yen when leaving? Understand the system to avoid unpaid taxes and visa trouble. We also explain the "Furusato Nozei" trick to get gifts for effectively 2,000 yen.

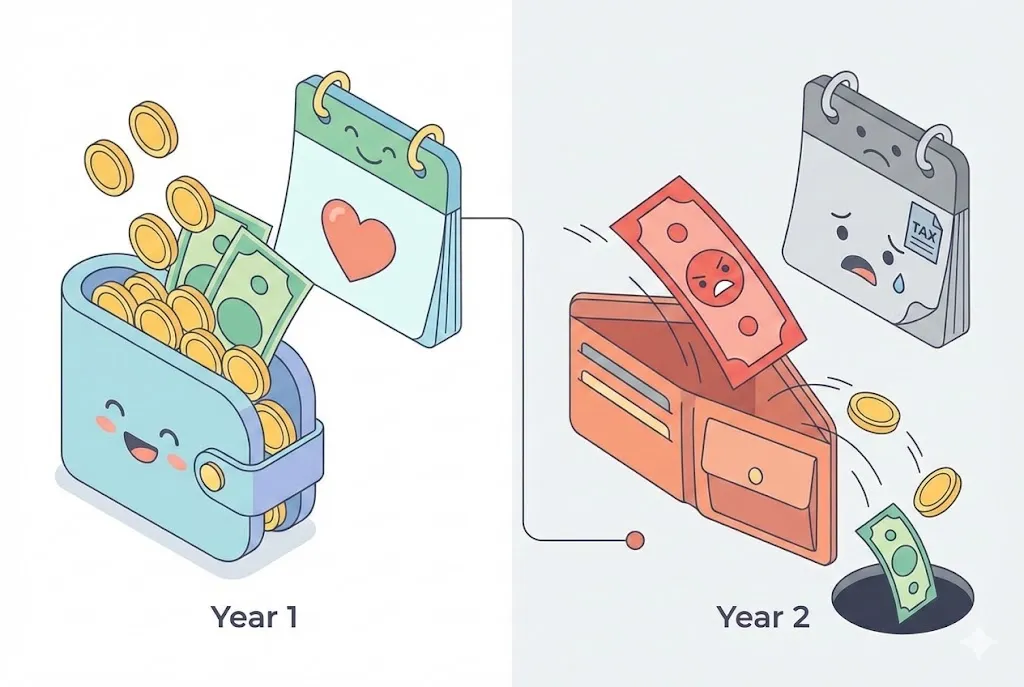

"Salaries in Japan are surprisingly high." Many people feel this way during their first year in Japan. However, in June of their second year, many foreigners freeze when they see their payslip. "Why has my take-home pay gone down? Is this a mistake by the company?"

No, it is not a mistake. This is the "2nd Year Residence Tax Shock" that every foreigner working in Japan inevitably faces.

Japan's Residence Tax system uses a very unique "Delayed Payment" method. If you don't understand this system, not only will your life become financially tighter in your second year, but you could also become the protagonist of a horror story where a "bill for hundreds of thousands of yen" arrives at your parents' house after you leave Japan (The Leaving Japan Trap).

In this article, we will thoroughly explain why your take-home pay decreases in your second year and the rules to avoid carrying debt when you return home.

If you also want to know about other items on your payslip (Income Tax and Social Insurance), please check the following article as well.

How to Read Your Japanese Payslip

Basics of Residence Tax: Why is it "Delayed Payment"?

There are two types of taxes in Japan: "Income Tax" and "Residence Tax." Income Tax is deducted from your monthly salary in real-time, but Residence Tax is different.

Residence Tax is calculated based on your "income from January to December of the previous year" and payments begin "from June of the following year."

The "Payment Gap" Timeline

- Year 1: Since your income in Japan for the previous year was zero, your Residence Tax is 0 yen. This is why your take-home pay feels higher.

- Year 2: From June, payments for the "tax on what you earned in Year 1" begin.

In other words, the high take-home pay in Year 1 was a "bonus stage." From Year 2 onwards, you will be billed an amount that includes 10% of your income plus a flat rate (Basic Fee) of approximately 5,000 yen per year.

On Reddit communities, there is no end to people who panic because they didn't know about this system.

In June of my second year at the company, my take-home pay dropped by 15,000 yen. I thought it was an accounting error and asked, but was told 'This is Residence Tax.' Nobody told me about this.

Simulation: Preparing for the "2nd Year Shock"

So, how much will it actually decrease? Let's look at rough estimates by annual income. Prepare yourself mentally.

- Annual Income 3 Million Yen: Take-home pay decreases by approx. 11,000 yen per month.

- Annual Income 5 Million Yen: Take-home pay decreases by approx. 20,000 yen per month.

If you are spending all of your salary in your first year, you will have to lower your standard of living in your second year.

Advice from Seniors: Think of the higher take-home pay in Year 1 as money meant for "saving." You should definitely save 15,000 to 20,000 yen every month to prepare for payments in Year 2. If saving is difficult, you need to review your fixed costs (especially rent) now.

The Leaving Japan Trap: The "January 1st Rule" and "Lump-sum Collection"

Residence Tax also bares its fangs when you leave Japan. The most important thing here is the "January 1st Rule."

"Anyone who has an address in Japan as of January 1st is obligated to pay the full Residence Tax for that year (based on the previous year's income)."

For example, even if you return to your home country on January 2nd, you must pay one year's worth of Residence Tax just for that single day. Conversely, if you leave on December 31st, you will not be charged Residence Tax for that year. Check the calendar carefully when deciding your departure date.

Difference in "Payment Method" by Retirement Month

What's even scarier is that the payment method changes depending on the month you resign.

-

If resigning between January and May: By law, the remaining Residence Tax up to May will be "collected in a lump sum" from your last paycheck.

User Review★☆☆☆☆1/5r/JapanFinance User When I quit in March, the Residence Tax was deducted in a lump sum from my last salary, and my take-home pay became almost zero. My funds for returning home were gone.

-

If resigning between June and December: You can switch to "Ordinary Collection" where you pay by yourself using payment slips sent from the city office.

Solution: If payments remain after you return home, you need to appoint a friend in Japan or a tax accountant as a "Tax Representative" to make payments on your behalf. If you leave the country forgetting this, you will be in a state of tax evasion.

What Happens If You Don't Pay? (Impact on Visa and Permanent Residency)

Thinking "They won't catch me if I go back home" is dangerous. Data on unpaid Residence Tax is shared, and if you ever want to return to Japan in the future, your visa may not be granted.

Especially for those planning to apply for Permanent Residency (PR), unpaid or late Residence Tax is fatal. Even a single late payment can be a reason for rejection.

If a "Red Envelope" arrives from the city office, it is a final warning. In the worst case, your bank account or salary will be seized.

I forgot the procedures when changing jobs and was in arrears for a few months, and my application for Permanent Residency was rejected.

The Trick to Make Residence Tax Cheaper: "Furusato Nozei"

Residence Tax is an obligation, but there is a smart way to pay it. That is "Furusato Nozei" (Hometown Tax Donation).

This is a system where by donating to a municipality of your choice, the amount donated minus 2,000 yen is deducted from the following year's Residence Tax (prepayment). The tax itself does not decrease, but as a thank you for the donation, you receive local specialties such as rice, meat, and fruits.

In other words, for an effective cost of 2,000 yen, you can get tens of thousands of yen worth of food. Furthermore, if you use Rakuten Furusato Nozei, you can also receive a maximum of 30.5% in point returns.

Conclusion: Protect Your Wallet with Knowledge

Japanese Residence Tax is complex, but it's not scary if you know the rules.

- Residence Tax is "Deferred Payment." Save money for the decrease in take-home pay in Year 2.

- If leaving, "End of December" is best. If you pass January 1st, you are taxed for a full year.

- Use "Furusato Nozei" to get local specialties instead of just paying taxes.

Start by understanding how much you need to pay and saving points to prepare for payment. If you have a Rakuten Card, you can save points on daily payments and use them to pay for living expenses or taxes.

Rakuten Card

Essential card to earn points even on Furusato Nozei.

Need help with life in Japan?

Visa, housing, work, money... Our experts are here to support you.

Check Support ServicesDisclaimer

※ The information in this article is accurate as of the time of writing. Laws and regulations may change, so please always check official sources for the latest information. We assume no liability for any damages resulting from the content of this article.