Cashless Japan 2025: PayPay vs. Rakuten Pay - Which App Should You Download?

CEO / Native Japanese Expert

Updated on: November 30, 2025

There are dozens of payment apps in Japan, but you only need two: PayPay and Rakuten Pay. We explain why these two are essential, the "Foreign Credit Card Trap," and how to maximize your points to save money on daily life.

Did you come to Japan hearing that "Cash is King"? It is true that old ramen shops and rural clinics often still only accept cash. However, Japan in 2025 has changed dramatically. You can now complete 90% of your daily life using just your smartphone.

PayPay, Rakuten Pay, LINE Pay, d-Barai... There are countless payment apps in Japan, but as a foreigner living here, you really only need two.

- PayPay: For Survival (Accepted almost everywhere)

- Rakuten Pay: For Savings (Earns the most points)

Here is why you need these two, and the "correct" way to use them together.

1. PayPay: The "Survival Tool" for Living in Japan

If you can only download one app, choose PayPay without hesitation. The reason is simple: "It is accepted at the overwhelming majority of shops."

Why PayPay is Essential

- Dominant Coverage: From high-end department stores to street food stalls (Yatai) and private hair salons, if a shop supports cashless payments, it is almost 100% guaranteed to accept PayPay. While "Cash Only" shops are decreasing, "Card Not Accepted / PayPay Only" shops are very common.

- The Standard for "Warikan" (Splitting Bills): When you go out for drinks with Japanese friends, the conversation at the register will almost always be, "I'll send it via PayPay." If you don't have it, dealing with small change can be a hassle.

- Cash Charge Available: Even if you don't have a Japanese bank account yet, you can charge your balance with cash at Seven Bank ATMs (inside 7-Eleven).

The Downside

- Low Reward Rate: The basic point return rate is 0.5%. It is convenient, but it won't help you save much money.

Note: To register for PayPay, a "Japanese phone number (070/080/090)" capable of receiving SMS is required. If you don't have a number yet, check the article below to get a SIM card.

2. Rakuten Pay: The "Money Machine"

If PayPay is the app for "spending," Rakuten Pay is the app for "earning." You should always use this app at major chains like 7-Eleven, FamilyMart, Seiyu Supermarket, and Matsumotokiyoshi.

Why Rakuten Pay is the Strongest

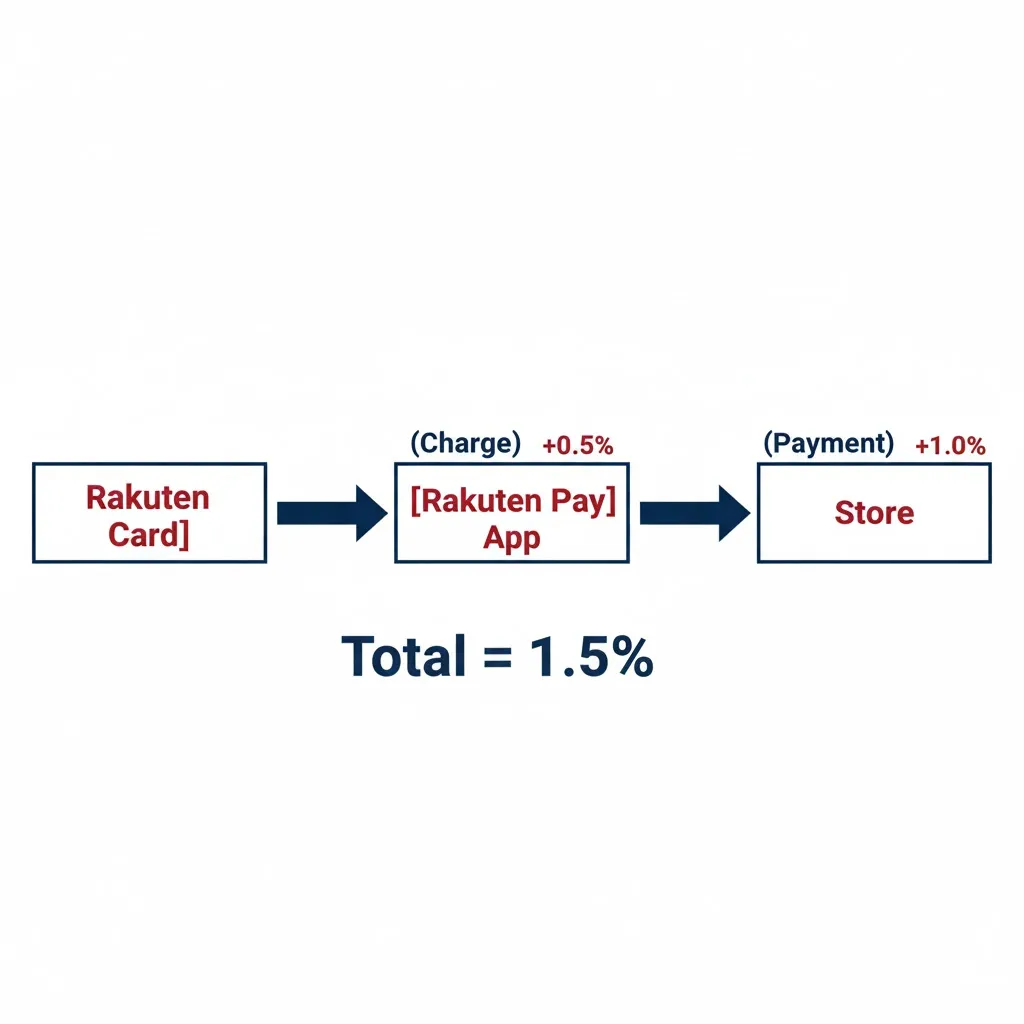

- The 1.5% Magic: This is the most important part. If you set your payment source to a Rakuten Card and charge your balance, the return rate jumps to 1.5%. This is 3x that of PayPay (0.5%).

- Using Limited Time Points: You can use "Limited Time Points" received from Rakuten Card campaigns directly for convenience store payments. This prevents you from wasting points before they expire.

- Suica Integration: You can also issue and charge a Mobile Suica directly within the app.

The "Golden Rule" of Cashless in Japan

Smart foreign residents use the apps like this:

- Small Shops & Splitting Bills with Friends → Use PayPay

- Convenience Stores, Supermarkets, Drugstores → Use Rakuten Pay

⚠️ The "Foreign Credit Card" Trap

Many foreigners try to register their credit cards from their home countries (US, Europe, etc.) to these apps and fail.

- PayPay: You can register foreign VISA/Mastercards, BUT there is a strict "3D Secure" barrier. Often, the usage limit is capped severely low (e.g., ¥5,000/month). You cannot use this to pay for furniture or rent.

- Rakuten Pay: While some foreign cards may be registered, they are not eligible for the 1.5% point return. The benefit of using the app is cut in half.

The Solution: Get a Japanese Card

If you are living in Japan, you should get a Rakuten Card as soon as possible. Not only does it maximize your points with Rakuten Pay, but it can also be registered as a payment source for PayPay (if it is a VISA/Mastercard brand).

🚀 Get the Strongest Cashless Card

To get the 1.5% return on Rakuten Pay, a Rakuten Card is essential. Here is how to apply (it is known for being foreigner-friendly).

👉 [Practical Guide] How to Apply for a Rakuten Card: English Tips & Avoiding Rejection

Comparison: PayPay vs. Rakuten Pay

| Feature | PayPay 🔴 | Rakuten Pay 🐼 |

|---|---|---|

| Best For | Small shops, Splitting bills | Supermarkets, Konbini, Drugstores |

| Point Rate | 0.5% (Basic) | 1.5% (Requires Rakuten Card) |

| Foreign Card | Limited (Low monthly cap) | No point benefits |

| Cash Charge | OK (Seven Bank ATM) | OK (Seven Bank ATM) |

| Send Money | Best (Everyone uses it) | Average |

| Bill Payment | Supports utility bills | Partially supported |

Step-by-Step Setup Guide

Setting up PayPay

- Download the PayPay App.

- Register with your Japanese mobile number (SMS verification).

- Identity Verification (eKYC): Verify using your Residence Card (Zairyu Card). This increases your spending limit and unlocks the money transfer feature.

Setting up Rakuten Pay

- Download the app and log in with your Rakuten ID.

- Set your Rakuten Card as the charge source.

- Crucial Setting: Go to settings and check "Use Points Priority" (ポイント優先). This ensures your points that are close to expiring are used automatically for daily shopping.

Frequently Asked Questions (FAQ)

Q1: Can I use these without a bank account? Yes, both can be charged with cash at Seven Bank ATMs (inside 7-Eleven). However, charging cash every time is a hassle, so we recommend getting a bank account or credit card soon.

Q2: If I can only choose one? If you prioritize convenience, choose "PayPay" because it is accepted almost everywhere. However, if you prioritize saving money, choose "Rakuten Pay (+ Rakuten Card)". The difference in points can amount to tens of thousands of yen per year.

Q3: Is the Rakuten Card review strict for foreigners? No, the Rakuten Card is known as one of the most accessible cards for foreigners. As long as you don't make mistakes on the application form, many students and workers successfully get one. Please refer to the guide below for details.

Conclusion

Don't overcomplicate it. Download PayPay so you can pay anywhere. Download Rakuten Pay + Rakuten Card to save 1.5% on your living costs.

1.5% might seem small, but when calculated against your annual food and daily necessities, it adds up to thousands or tens of thousands of yen. That is enough for a nice dinner or to help pay for a flight home.

🔥 Start Your Point Life Today

Stop losing money by paying with cash. Get a Rakuten Card and start your 1.5% cashback life.

👉 [Practical Guide] How to Apply for a Rakuten Card: English Tips & Avoiding Rejection

Need help with life in Japan?

Visa, housing, work, money... Our experts are here to support you.

Check Support ServicesDisclaimer

※ The information in this article is accurate as of the time of writing. Laws and regulations may change, so please always check official sources for the latest information. We assume no liability for any damages resulting from the content of this article.