Cost of Living in Tokyo 2025: Monthly Breakdown & Money-Saving Hacks

CEO / Native Japanese Expert

Updated on: December 5, 2025

The estimated cost of living for a single person in Tokyo in 2025 ranges from ¥140,000 to ¥250,000 per month. This guide breaks down rent averages, winter utility spikes, and food inflation, while exposing the "Year 2 Residence Tax" trap and high initial move-in costs. Learn how to lower your fixed costs and save money.

Starting a new life in Tokyo is exhilarating. The neon lights of Shinjuku, the serene shrine grounds, and the endless bowls of delicious ramen. However, once the initial excitement settles, many international residents face a harsh reality.

"In Tokyo, it costs money just to breathe."

According to the latest data for 2025, a single foreigner living in Tokyo needs a monthly budget ranging from ¥140,000 (Saver Mode) to ¥250,000 (Standard Mode). On top of that, the weak yen and inflation have driven up the price of groceries at supermarkets.

But don't panic just yet. The truth is, many people struggling financially in Tokyo are simply paying for "expenses they could have avoided if they knew better."

In this article, we won't just look at statistical data. We will dissect the cost of living using real failure stories from foreign residents (via Reddit). By the time you finish reading, you will understand exactly where to cut costs to live smartly in Japan's capital.

1. Rent: The Biggest Cost & The "Initial Cost" Trap

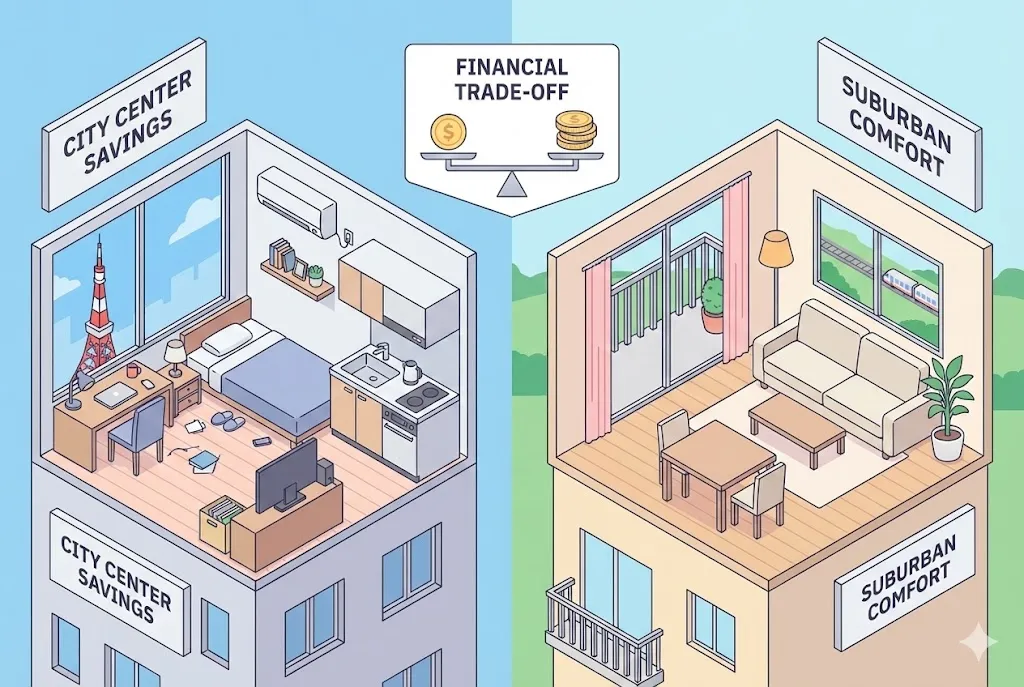

Rent accounts for nearly half of your living expenses. House hunting in Tokyo is always a trade-off between "Commute Time" and "Rent."

Average Rent by Area (2025 Edition)

First, let's look at the market rates for a single person (1K / 1R studio apartment).

- City Center (Minato, Shibuya, Shinjuku, etc.)

- Average: ¥110,000 - ¥135,000

- Features: Convenient for everything, but the rooms are tiny (shoeboxes), making it hard to save money.

- Suburbs (Nerima, Adachi, Edogawa, etc.)

- Average: ¥60,000 - ¥75,000

- Features: It takes 30-50 minutes by train to get downtown, but the rent is almost half.

On Reddit, the following advice has gathered a lot of support:

Trying to live inside the Yamanote Line on a take-home salary of ¥250k is financial suicide. If you commute 45 minutes from Saitama or Chiba, you get twice the space for half the rent.

[Important] Beware of the Hidden "Initial Costs"

What shocks foreigners even more than the monthly rent is the "Initial Cost" required when moving in. In Japan, it is common to pay 4.5 to 5 months' worth of rent upfront for the Security Deposit, Key Money, Agency Fee, and Guarantor Fee.

- Example: Renting an ¥80,000 apartment → You need about ¥400,000 in cash upfront.

- Key Money (Reikin): This is a "gift" paid to the landlord that is never returned. Many foreigners find this system baffling.

However, don't give up yet. By using real estate agents specializing in foreign residents, you can drastically reduce these costs.

2. Utilities & Phone: The Easiest Way to Save ¥10,000/Month

The next biggest fixed costs are utilities and communication fees. This is an area where having the right "knowledge" can cut your bills in half.

The Reality of Utilities (Electricity, Gas, Water)

- Monthly Average: Approx. ¥12,000 (Spring/Autumn)

- Winter Warning: Japanese houses have poor insulation, so AC and gas bills skyrocket in winter. Expect costs to rise by at least +¥5,000 on average.

The biggest trap here is "Propane Gas (LPG)."

I thought I signed up for City Gas, but it was Propane. The base fee alone was ¥2,000, and my winter gas bill went over ¥15,000. Absolutely choose City Gas.

When choosing an apartment, always ask: "Is this City Gas?"

The "Mobile Gap": Are You Overpaying?

If you are still using a SIM card from a major carrier (Docomo, Au, Softbank) that you signed up for at the airport or an electronics store, you should review it immediately.

- Major Carriers: ¥7,000 - ¥9,000 / month

- Budget SIM (MVNO): ¥2,000 - ¥3,000 / month

The connection quality is almost the same, yet you are paying ¥5,000 more every month—that's ¥60,000 a year. That’s enough for 10 nice dinners in Tokyo.

3. Food: Survival Tactics in the Inflation Era

In 2025, food prices in Japanese supermarkets are rising. The price hikes for imported foods (cheese, meat) and coffee are particularly noticeable.

- Cooking at Home: ¥25,000 - ¥30,000 / month

- Eating Out: ¥50,000 - ¥60,000 / month

If you eat convenience store bento boxes or lunch sets (¥1,000+) every day, your food expenses will easily exceed ¥60,000. Adopt the "3 Rules" practiced by veteran foreign residents in Tokyo:

- The Konbini Ban: Convenience stores are convenient but overpriced. Buy drinks at drugstores or supermarkets for half the price.

- Gyomu Super: This wholesale supermarket chain is a lifeline for foreigners in Tokyo. Their frozen meat and pasta are incredibly cheap.

- Closing Sales: Go to supermarkets after 8 PM. Look for the "Half-price sticker" (Hangaku) on deli items and bento boxes.

Gyomu Super's frozen meat and pasta save my life. You can buy them for half the price of regular supermarkets, so it's essential if you cook at home.

4. Taxes & Insurance: The "Year 2" Pay Cut Trap

Finally, let's talk about the biggest pitfall many foreigners fall into unknowingly: "Residence Tax in Year 2."

When you look at your Japanese payslip, Income Tax and Social Insurance are deducted. However, in your first year, "Residence Tax" is NOT deducted. Residence Tax is calculated based on your "previous year's income" and billing starts from June of the following year.

Common Screams on Reddit

I got a red envelope from the ward office. It says I owe ¥200,000 for last year's taxes. I already spent the money...

Advice: The higher take-home pay in your first year is not a "bonus." You must save ¥15,000 - ¥20,000 every month to prepare for Year 2 payments.

For more details, read our guide on How Residence Tax Works and Why Your Paycheck Shrinks.

5. Summary: Your Cost of Living Simulation

Summarizing everything, here is what the cost of living in Tokyo looks like. Which style will you choose?

| Item | ① Saver Mode (Survival) | ② Standard Mode (Comfort) |

|---|---|---|

| Target | Students, Young Savers | Office Workers, Comfort Seekers |

| Area | Suburbs | City Center |

| Rent | ¥65,000 | ¥110,000 |

| Utilities | ¥9,000 (City Gas/Power Saving) | ¥14,000 (Comfort Use) |

| Phone/Net | ¥2,500 (Budget SIM) | ¥8,000 (Major Carrier) |

| Food | ¥30,000 (Cooking/Gyomu Super) | ¥50,000 (Eating Out/Konbini) |

| Others | ¥15,000 | ¥30,000 |

| Total (Monthly) | ¥121,500 | ¥212,000 |

| Required Salary | Approx. ¥2.2M+ / year | Approx. ¥3.5M+ / year |

Conclusion: How to Stay in the Black

Living in Tokyo costs money, but it is controllable. Rather than starving yourself to save on food, the smart way is to review the "fixed costs that stay cheap once you set them up."

Start with the easiest steps you can take today:

- Review your Phone Bill: Switch from a major carrier to a Budget SIM to save ¥6,000/month.

- House Hunt Smartly: Choose "Zero Key Money" and "City Gas" properties for your next move.

- Earn Points: Consolidate daily payments onto a "Rakuten Card" to cover living expenses with points.

Need help with life in Japan?

Visa, housing, work, money... Our experts are here to support you.

Check Support ServicesDisclaimer

※ The information in this article is accurate as of the time of writing. Laws and regulations may change, so please always check official sources for the latest information. We assume no liability for any damages resulting from the content of this article.