[The 2026 Problem] No Visa Renewal if Pension is Unpaid? Stricter Immigration Rules Under the New Takaichi Administration & Tax Steps Foreigners Must Take Now

CEO / Native Japanese Expert

Updated on: December 8, 2025

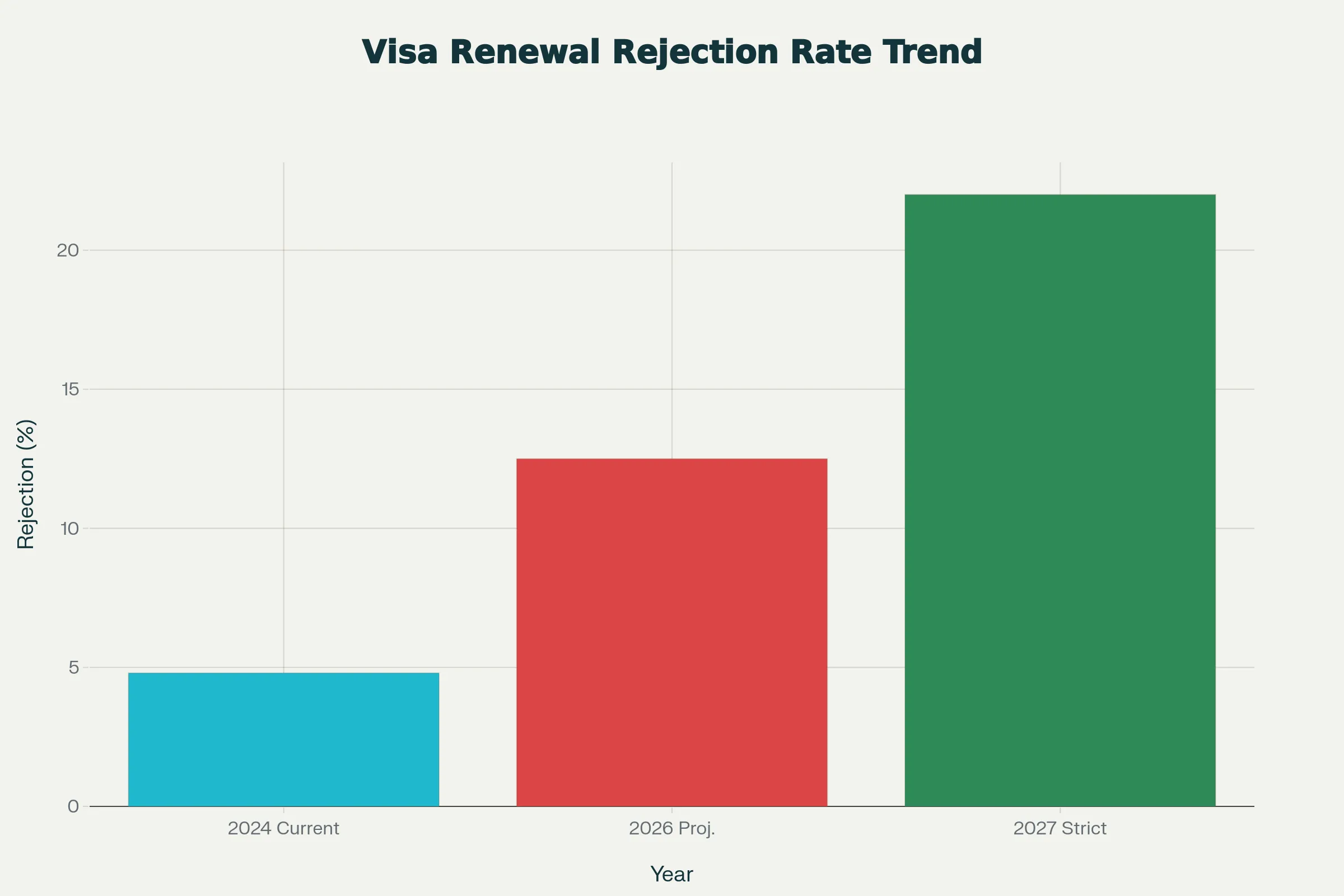

Visa renewal screening will tighten starting in 2026. Unpaid pension/residence tax or undeclared side income could lead to immediate rejection. We urgently explain the tax return and social insurance measures needed to protect your visa.

"Visa renewal? I just need to have my company submit the documents and I'll be fine, right?"

If that is what you are thinking, 2026 might be the last year of your life in Japan.

In December 2025, the "Stricter Immigration Control" policy announced under the new Takaichi administration sent shockwaves through the foreign resident community. This is because the issue of unpaid pension and taxes, which was previously only strictly scrutinized for "Permanent Residency" applications, is now extremely likely to be applied to standard visa renewals (Engineer/Specialist in Humanities/International Services, etc.) as well.

"I didn't know" will no longer be a valid excuse. In this article, we explain the "Tax and Career Survival Strategy" you need to implement immediately to protect your residence status in the face of the 2026 Problem.

Why the "2026 Problem" Now?

Until now, Japan's immigration policy has been relatively "lenient" to compensate for labor shortages. However, the current trend is shifting clearly toward "Strict Legal Compliance."

The graph below shows the projected trend in visa renewal rejection rates accompanying stricter tax compliance measures.

1. Strengthened Data Sharing Between Immigration and the NTA

Previously, it took time for the Immigration Services Agency to grasp an individual's detailed tax situation. However, with the integration of the My Number system, a mechanism is being finalized where "who owes how much tax and when" is shared instantly between the National Tax Agency and Immigration.

2. Redefinition of "Good Conduct"

The term "Good Conduct" (Soko Zenryo) is a requirement for visa renewal. Until now, this mainly meant "not having committed crimes," but moving forward, "paying Social Insurance premiums (Pension/Health Insurance) and Residence Tax on time" will become an essential condition.

You are at high risk if:

- You ignore the pension payment slips (pink envelopes) and leave them unpaid.

- You earn money from a side job but have not filed a tax return.

- Your company does not enroll you in Social Insurance, and you are behind on National Health Insurance payments.

Risk Level 1: "Undeclared" Side Job & Freelance Income

This is a particularly common case among foreigners working as engineers, designers, and marketers. "I just earned a little from UberEats." "I got paid by an overseas client via Upwork."

All of these are taxable income.

Under Japanese law, if your income other than your salary (side jobs, etc.) exceeds ¥200,000 per year, you are required to file a Final Tax Return (Kakutei Shinkoku). Neglecting this is considered "tax evasion" and creates a risk of your next visa renewal being denied.

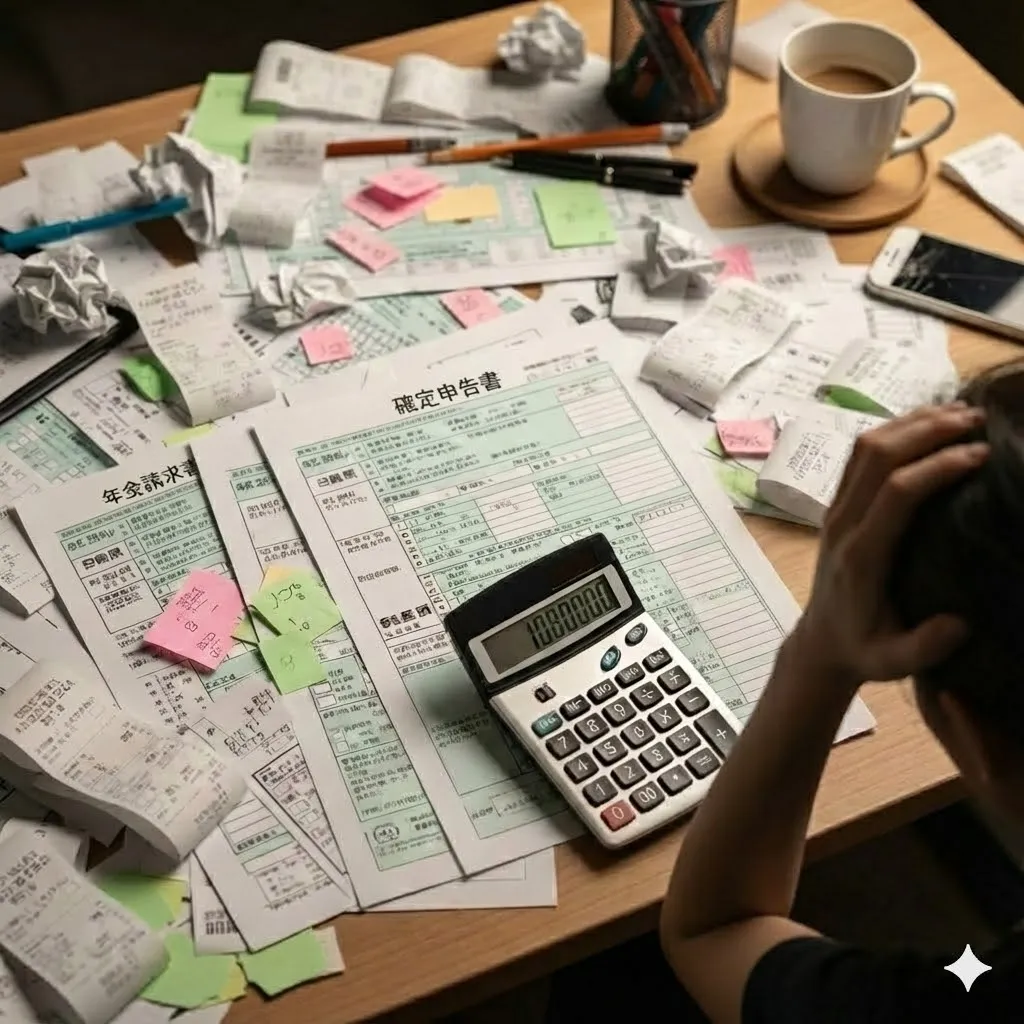

Solution: Prepare for "Kakutei Shinkoku" Immediately

There is no need to give up thinking, "Hiring a tax accountant costs over ¥100,000, and the Japanese forms are too difficult..." Nowadays, there are apps that allow you to create tax returns just by answering questions on your smartphone.

Compared to the risk of losing your visa, a cost of around ¥1,000 per month is a very cheap investment.

File a 'Perfect' Tax Return for Visa Renewal

A mistake in tax calculation can be fatal. Just take photos of your receipts with your smartphone, and the AI will automatically create your ledger. With translation tools, it's easy even for foreigners.

※ For specific steps on filing tax returns and deductions, please refer to the Complete Guide to Tax Returns for Foreigners.

Risk Level 2: Non-Enrollment in Social Insurance by "Black Companies"

"We are a small company, so we don't have Social Insurance (Shakai Hoken). You have to join the National Health Insurance yourself."

If your company tells you this, you are in a dangerous situation. If you are a regular employee (or on a contract close to full-time), the company has a legal obligation to enroll you in Social Insurance. Continuing to stay at a company that refuses this could be viewed as you being complicit in an "illegal state."

Furthermore, if you pay the National Pension and National Health Insurance yourself, the monthly burden is high, and the risk of forgetting to pay increases drastically.

Solution: Change Jobs to a Compliant Company (Escape)

You do not need to be loyal to a company that does not protect your visa. Before the stricter screening begins in 2026, moving to a "White Company" with complete Social Insurance is the strongest visa defense strategy.

Search Only for Jobs with 'Complete Social Insurance'

Many listings from global and foreign-affiliated companies that offer visa support and comply with laws. Escape from black companies and secure the safety of your residence status.

For advice on how to proceed with job hunting safely, please refer to the Guide to Successful Job Changes in Japan.

Action List to Survive 2026

While the Takaichi administration's policy is strict, foreigners who follow the rules have nothing to fear. Please execute the following checklist immediately.

- Check "Nenkin Net" Check if there are any past unpaid periods, and if so, consult about making back payments.

- Pay off Residence Tax (Juminzei) completely Residence tax is the most common tax to fall behind on. Go to your city hall and confirm there are no outstanding payments.

- Separate your bank accounts for side jobs To make tax filing smoother, prepare a bank account specifically for business. (Reference: Bank Account Opening Guide for Foreigners)

"I want to continue living in Japan." If you have that will, take action now. Whether it's preparing for tax returns or considering a job change, the sooner you act, the more options you will have.

Frequently Asked Questions (FAQ)

Q1. Is it true that I won't be able to renew my visa if I have unpaid pension starting in 2026?

A. Yes, it is highly likely. Due to the policy shift in 2025, Immigration is strictly checking the payment status of taxes and social insurance premiums during residence status renewal examinations. The trend is that unpaid statuses are becoming a negative factor not only for Permanent Residency but also for the renewal of work visas.

Q2. Is a tax return necessary even if my side income is small?

A. If your side income is ¥200,000 or less per year, a Final Tax Return for Income Tax is not required, but you must file for Residence Tax. To protect your credibility during visa renewal, we recommend declaring even small amounts with transparency.

Need help with life in Japan?

Visa, housing, work, money... Our experts are here to support you.

Check Support ServicesDisclaimer

※ The information in this article is accurate as of the time of writing. Laws and regulations may change, so please always check official sources for the latest information. We assume no liability for any damages resulting from the content of this article.

Related Articles

[2025 Picks] Top 5 Rental Services for Foreigners in Japan: Compared by English Support & Approval Rates

[2025 Guide] The Truth About Japanese Apartment "Initial Costs": Understanding Deposit, Key Money, and How to Negotiate